Home prices have returned to 1997 levels October 29, 2008

Posted by Jeff Nabers in Money, Precious Metals, real estate, Self Directed IRA/401k.Tags: 401k, case-shiller, dollar, economy, fed, gold, home, housing, inflation, ira, median, Money, precious metal, preservation, prices, real estate, risk, self directed, solo, solo 401, wealth

1 comment so far

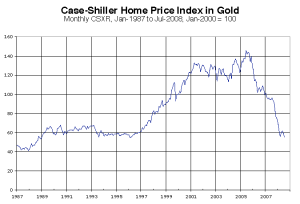

One of the reasons that everyone seems to act so surprised at the “economic meltdown” is because we measure everything in U.S. Dollars while paying little attention to the value of the dollar itself. The dollar is a floating currency. The amount of dollars in circulation can dramatically increase or decrease in any given period of time as seen fit by the central bank, the Fed. An increase in the money supply will push prices up, while a decrease in the money supply pushes prices downward. Therefore, an asset’s true value can remain constant while it’s dollar denominated value can fluctuate – and vice versa.

Looking at statistics or charts denominated in U.S. Dollars can be very deceiving, and if that’s what you’ve been doing, then you were blindsided by the recent collapse of various markets and institutions. If during the past decade you were looking at real prices (as measured in grams of gold) it would have been quite apparent that housing prices were experiencing erratic growth that was likely unsustainable. Gold has been the real currency used by humans since the dawn of time, and even after Nixon took us off the gold standard in 1971, all markets continue to follow logical boundaries of movement as priced in gold.

The good news is that (more…)