How you just lost money in a stock market that’s up 40% August 5, 2009

Posted by Jeff Nabers in Money, Personal Productivity, Self Directed IRA/401k.Tags: 1913, chart, collapse, crash, currency, depression, dollar, dow jones, fed, fiat, gains, history, inflation, invest, investing, investment, long run, long term, losses, rebound, recession, risk, stock market

2 comments

Headlines abound, the stock market is up 40% from its March lows!!! Let’s all celebrate. Those who spoke badly of Obama, Bernanke, and Geithner have their foots in their mouths, right?

Not even close. These types of misleading headlines are the very weaponry of a financial system that tricks you, lures you, spikes your drink, robs you blind while you’re partying, and then nurses you back to sobriety in the morning by giving you another spiked drink.

Imagine you have $100 in the stock market. You experience a 40% loss. You now have $60. And, abracadabra, the economic rescuers have juiced the market back up 40%. You now have $84. Wait a tick, how exactly do I get back to $100? Well to recover from a 40% loss, you would need a 67% gain. You see, 40% of $60 is much less than 40% of $100, so the initial 40% loss was much larger than the 40% gain that followed. For those whose livelihood involves serious math, this is very obvious. For the rest of us, it should be an “ah ha” moment that exposes the red arrow, green arrow game.

Watching and listening to the financial news networks report about the stock market is like watching a sports game. And it entertains just like a sports game. In the midst of entertaining, it lulls us into watching the red and green arrows. Oh, it’s down today a few points. Hey look, it came back up. It feels very much like watching a basketball team surrender and regain the lead in a basketball game. If they are down by 40 points, and then they score 41 uncontested points, they have the lead and they win the game!

But it doesn’t work the same in percentage points. But just wait, over the long term the losses will be recovered and there will be profit, say the “experts” whose payroll checks are signed by Wall Street. If you buy that line of baloney, you will be further tricked. Because over the long term those losses will be recovered and there will be profits… but only as measured in dollars. If you factor in how over the long term those dollars buy less stuff, you will not find a substantial long-term profit.

Today the Dow closed at $9,320. But the dollar has lost over 96% of its purchasing power since 1913. Take 96% out of today’s Dow price and you get $372. In 1913, the Dow was at about $62. So the Dow Jones Industrial Average grew from $62 to $372 (in constant 1913 dollars) over a period of 96 years. That’s an annualized rate of return of 1.88%.

This bears repeating…

The Dow Jones has returned 1.88% per year for the past 96 years

Can you still get excited about a stock market that’s up 40% since its March lows when it is still a stock market that hasn’t even been able to produce an actual 2.00% return over the long run?

Or even more important questions: Is it worth the risk of losing a big chunk of the money you worked for just to “get some action” in a market that produces less than a 2.00% return over the long run? When you are down, can you wait decades without touching your money just to get back to your break-even point?

—-

Jeff Nabers is author of 5 STEPS TO FREEDOM: How to Cut Your Dependence on Institutions and Escape Financial Slavery

Weak economy strengthens the incentive for a Solo 401k October 18, 2008

Posted by Jeff Nabers in Money, real estate, Self Directed IRA/401k.Tags: 401k, dollar, economy, inflation, invest, investing, ira, meltdown, profit, real estate, self directed, solo, Solo 401k, wealth

2 comments

This is quite a simple concept so this post will be very brief.

- Our weak economy has brought very high inflation: currently 13% per year.

- Future dollars are worth much less than dollars today.

- With a Solo 401k you can make tax-deductible contributions to your retirement plan in today’s dollars and pay taxes later in less valuable dollars.

- Successful entrepreneurs and self employed individuals can contribute $46,000 per year or more to their Solo 401k.

del.icio.us ::

del.icio.us ::  Digg this ::

Digg this ::  Stumble it ::

Stumble it ::  reddit ::

reddit ::  facebook

facebook

I.O.U.S.A – Former U.S. Controller warns country’s finances are unsustainable August 24, 2008

Posted by Jeff Nabers in Money.Tags: alan greenspan, budget, country, currecny, dollar, fed, government, i.o.u.s.a., inflation, Money, solvent, sovereign, spending, taxes, unites states, warren buffett

add a comment

This week I attended a special viewing of a new documentary, I.O.U.S.A. This film substantiates the concerns that our country’s government and citizens are going broke. One of the main authorities featured is David Walker, former U.S. Comptroller General. Other notables include Warren Buffett (CEO of Berkshire Hathaway), Alan Greenspan (former Fed chairman), Paul O’Neill (former U.S. Secretary of Treasury), Robert Rubin (former U.S. Secretary of Treasury), Paul Volcker (former Fed chairman), and Bob Bixby.

Following the viewing of the film itself was a live satellite feed of a town hall discussion including Buffett, Walker, Pete Peterson (chairman of The Blackstone Group & chairman of the Peter G. Peterson Foundation), William Niskanen (chairman of the CATO institute), and Bill Novelli (CEO of AARP).

The Documentary

I expected the film itself to be very eye opening, and that it was. All I can say is you should go see it immediately. Check here to see when it’s showing in your city. If you think that all of the talk of the government heading towards bankruptcy is a bunch of fear mongering, then you owe it to yourself to let this film play devil’s advocate. Opinions are one thing, but I.O.U.S.A. certainly isn’t void of facts.

Live Discussion

The town hall discussion afterward was also rather informative. Truth be told, Warren Buffett’s involvement in this event is what caught my attention enough to attend. When it came down to the actual live (satellite fed) discussion following the film, Buffett was virtually useless. In one of his first comments, he said something about how we was going to be the “pollyanna” of the group. Just as promised, every time Buffett opened his mouth something came out about how our finances will just turn out magnificent because of America’s greatness. These comments were squeezed in between others’ contradictory sentiments explaining that simple unbiased economic forecasting holds the squandering of our greatness in the future if something isn’t done to change our path.

Of course Americans themselves are beating a path to the poor house, but that wasn’t the focus of the film. Much more attention was paid to the finances of the U.S. government. I walked away from this film with the sense that, in all probability, there are three places for us to end up in the next decade or two:

- MUCH higher taxes – Who wants to live in a place with taxes higher than socialist countries, yet without free college, medical care, or any other actual benefit?

- Governmental & economic collapse – The world has seen many countries rise and fall. No economic system defies the economic/mathematical laws on which it’s built.

- Major federal government reduction – Most of the “government” programs we actually see/use/need are actually from local or state government… such as roads, police departments, fire departments, etc. If we all woke up tomorrow with 80% less laws, 80% less government programs, and 80% less government spending, I don’t think it would be the chaotic anarchy that some people might imagine.

The Bottom Line

Most everything that we each do throughout our normal day is based on the assumption that things are being taken care of in a sound manner in Washington, D.C. and in the board room of the Fed. We go about our lives as if we will be the richest and most powerful country in the world forever. This film will shatter these assumptions and divert your attention to an undeniable fact: Some major changes must take place soon in order for the United States to remain a solvent and sovereign country.

Lunch at the Fed August 22, 2008

Posted by Jeff Nabers in Money, real estate, Self Directed IRA/401k.Tags: 401k, bank, bernanke, bls, cpi, currency, dollar, fed, foreign, forex, inflation, ira, Money, ppi, real estate, self directed, solo, Solo 401k, world trade center

add a comment

I recently attended a lunch discussion at the Fed building here in Denver hosted by the World Trade Center. The topic of discussion: The outlook for the U.S. Dollar.

First, a Federal Reserve senior economist gave us an overview of what Fed is and how it works. Surprisingly, he was quite direct and open about Fed’s control over increasing & decreasing the money supply by simply deciding to buy or sell “government securities” from or to its member banks. (If everyone would have grasped that statement fully, the “forecasting” of USD activity would have been unnecessary.)

The floor was then passed to Russ Root, ForEx advisor at Amegy Bank. He mentioned PPI (Producer Price Index), aka “pipeline inflation”, being around 9.2%. He made some comments about Fed chairman Bernanke currently asking Congress to consolidate & fortify Fed’s powers. I understand Fed’s job is essentially to attempt to rid America of the economic cycle, thus making all our lives recession/depression-free. Economically speaking, this is impossible when operating a system on fiat currency. So, each time a new Fed chairman gets appointed, he has failed at his task before starting it. For this reason, word of Bernanke asking for “more powers” is alarming. It’s like losing a game of blackjack and doubling your bet after each loss… throwing more money or power after a losing game is a silly thing.

Mr. Root described the situation with the dollar as “the race to the bottom”. To summarize his message, “we win”. We’ve won the race to the bottom, and his bet is on a stronger dollar over the next 18 months. Oddly enough, he didn’t explain why or how the dollar’s rebound will occur beyond the logic of “what goes down must come up”. It’s not a surprising prediction considering the venue.

Beyond my thirst for knowledge relating to fully understanding money, my reason for attending this meeting was to consider joining the World Trade Center. Contrary to common awareness, the WTC is more than just a pair of buildings that toppled in Manhattan. It’s actually an association of individuals and companies involved in international trade. This interests me because I believe there are countless strong investment opportunities outside our borders. Most of the attendees of this lunch meeting were WTC members.

One WTC member posed the question, “The 30 year bond should be at 13%. How long will these other countries keep propping us up?” His concern wasn’t exactly addressed. I mean whoever does know “how long these other countries will keep propping us up” is going to become a rich (or richer) man applying that knowledge and keeping quiet. Of course, this was really more of a comment about his concern that our financial circumstances are currently highly dependent on foreign countries. I haven’t yet decided whether to join WTC. I am primarily looking to connect with international real estate brokers who can facilitate transactions in South America and Asia. Suggestions in comments appreciated.

Does the weak dollar make foreign real estate a bad investment? August 7, 2008

Posted by Jeff Nabers in Money, real estate, Self Directed IRA/401k.Tags: collapse, currency, debasement, deflation, depression, dollar, economy, fed, foreign, inflation, international, invest, investing, investment, properties, property, protect, real estate, recession, rent, rents, wealth

add a comment

In a recent meeting with a couple of real estate investors, I was posed with the question:

Doesn’t the weak dollar eat into the profit of foreign real estate investing?

Not at all; in fact, quite the contrary. A weak dollar makes spending dollars in foreign countries disadvantageous. I ran into this a few years ago in Sweden. I went to buy a t-shirt and it cost the equivalent of $85 USD. I asked my Swedish friend if this shirt was expensive, and he replied “no”. That’s when I learned firsthand that the plummeting dollar is making international vacationing more expensive for Americans.

Spending money on foreign real estate

The same does apply to real estate purchase for personal use. If you find a beautiful property in a foreign country that you’d like to buy for personal use, it’s going to cost a lot more today than it did 5 years ago. You’re spending US dollars and you’re going to have to spend a lot more now since they are worth less thanks to inflation.

Investing money in foreign real estate

Investment into real estate is done to accomplish one or both of the following objectives:

- Produce [Rental] Income – I believe this should be the primary objective of any investment. Income is more predicable and controllable than appreciation.

- Appreciation / Capital Gains – This is the focus of most novice investors.

When investing in foreign real estate, you convert the appropriate amount of US Dollars into local currency, and you will purchase the property in local currency. Regardless of whether you receive your return on investment from #1 above, #2 above or both… you will receive it in local currency. If you buy property in Sweden, you will receive rental income in kronor (Swedish crowns) and proceeds from the sale of the property will also be in Swedish crowns.

Scenario 1. If the dollar is weak (relative to its historic value), but its value remains constant during your ownership of the Swedish property, your return-on-investment (ROI) will be unaffected by the dollar’s weakness.

Scenario 2. If the dollar is weak, and it continues to weaken during your ownership of the Swedish property, your ROI in Swedish crowns will remain unaffected, but in USD your ROI will be increased.

Scenario 3. If the dollar is weak, but it rebounds and strengthens in value during your ownership of the Swedish property, in USD your ROI will suffer. The dollar can only bounce back if the Fed completely reverses its monetary policy. In this case, interest rates will go up to 13% – 20%, and the entire US economy will essentially crash. Here there will be so many opportunities that as long as you didn’t put your entire investment portfolio into the Swedish property, riding the bear market down in short positions will more than compensate for the lessened ROI on the Swedish property.

Weakening dollar makes domestic real estate investment a bad idea

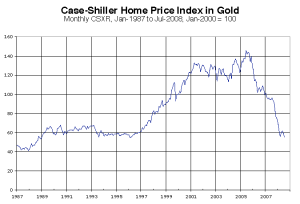

The weakened dollar has hurt real estate in the last 2 years. During this time, inflation has been at 10% – 12%, while housing values have been stagnant or even declined in some localities. This means all our homes have decreased in actual value 10%+.

If you believe interest rates will remain low and that Fed will continue its inflationary policies, investing in U.S. real estate might not carry a very good ROI. If your property is returning you 12% annually, but inflation is at 12%… you have successfully stored and protected your wealth, but you have not grown it. The continued weakening dollar will hurt domestic real estate unless real estate appreciation outpaces inflation. Using the increasing money supply as a forecaster, inflation is heading towards 16%. I don’t think real estate values (or rents) will increase by 16% per year over the next few years, so this tells me that while our inflation continues, domestic real estate investment performance [in general] will suffer.

Summary

- The weakened dollar has made spending money in foreign countries expensive for Americans.

- The weakened dollar has not affected real estate investment into foreign countries.

- Should the dollar’s weakening/debasement continue, ROI in foreign investments will increase.

- Should Fed’s monetary policy reverse, we will experience deflation and an economic collapse. In this circumstance, there will be tremendous investment opportunities for anyone who has enough liquidity to take advantage of the moving markets.

Concepts to consider

- Reduce your exposure to the US Dollar now to protect your wealth

- Keep enough liquidity to enable you to react to the possibility of coming reversal in Fed’s monetary inflationary policies

- Hold that liquidity in assets denominated in a foreign currency – preferably a currency from a country whose monetary system is generally sound and stable such as Canada or Switzerland